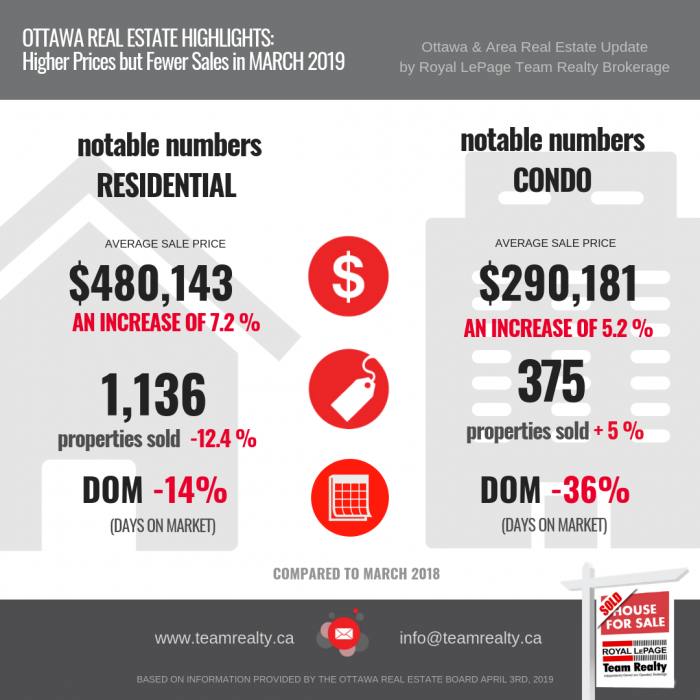

OTTAWA REAL ESTATE HIGHLIGHTS: Higher Prices, Fewer Residential Sales

Tightness of listing supply is significantly reducing days on market, properties are selling very quickly. The latest statistics are out from the Ottawa Real Estate board! here are the highlights... 1,511 residential properties were sold in March through the Board’s Multiple Listing Service® System, compared with 1,654 in March 2018, a decrease of 8.6 per cent. 1,136 in the residential property class, a drop of 12.4 per cent from a year ago, and 375 in the condominium property class, an increase of 5 per cent from March 2018. The five-year average for March unit sales is 1,402. The average sale price of a residential-class property sold in March in the Ottawa area was $480,143, a rise of 7.2 per cent over March 2018. The average sale price for a condominium-class property was $290,181, an increase of 5.2 per cent from this month last year.* The average sale price of a residential-class property sold in March in the Ottawa area was $480,143, a rise of 7.2 per cent over March 2018. The average sale price for a condominium-class property was $290,181, an increase of 5.2 per cent from this month last year.* The $300,000 to $449,999 price range continued to represent the most active price point in the residential market, accounting for 43 per cent of March’s sales 1 in 4 residential sales was in the $500,000 to $749,999 range. The most prevalent price point in the condominium market increased to the $225,000-$349,999 price range, accounting for 49 per cent of the units sold. “Lack of inventory is responsible for March’s deficiency in residential unit sales. This tightness of supply is manifesting in significant reductions in DOMs (days on market) and properties selling very quickly. Residential DOMs are down 14%, and condo DOMs are down 36% from last year.” “In some pockets of the city, buyers are facing multiple offer situations, and properties are often selling over list price. These dynamics of low inventory, reduced days on market, and multiple offers are signs of a seller’s market in these areas. While a benefit to those sellers, it’s stressful and time consuming for buyers. The experience and guidance of a REALTOR® is essential in these types of market conditions,” = “In Ottawa, we have a population base that’s increasing year over year with a growth rate of 8.8 percent, which is higher than Ontario (5.7%) and Canada as a whole (5.9%). Immigration and high employment levels are bringing residents to our desirable and affordable city,” he suggests. “With high demand and limited supply, prices will continue to be pushed upwards – it’s a simple and fundamental economic principle. Although we appreciate the recent measures the federal government has taken towards affordable homeownership, all three levels of government need to work together at implementing mechanisms that will also restore the supply side of the market.” * The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood.

The latest statistics are out from the Ottawa Real Estate board! here are the highlights... “Lack of inventory is responsible for March’s deficiency in residential unit sales. This tightness of supply is manifesting in significant reductions in DOMs (days on market) and properties selling very quickly. Residential DOMs are down 14%, and condo DOMs are down 36% from last year.” “In some pockets of the city, buyers are facing multiple offer situations, and properties are often selling over list price. These dynamics of low inventory, reduced days on market, and multiple offers are signs of a seller’s market in these areas. While a benefit to those sellers, it’s stressful and time consuming for buyers. The experience and guidance of a REALTOR® is essential in these types of market conditions,” = “In Ottawa, we have a population base that’s increasing year over year with a growth rate of 8.8 percent, which is higher than Ontario (5.7%) and Canada as a whole (5.9%). Immigration and high employment levels are bringing residents to our desirable and affordable city,” he suggests. “With high demand and limited supply, prices will continue to be pushed upwards – it’s a simple and fundamental economic principle. Although we appreciate the recent measures the federal government has taken towards affordable homeownership, all three levels of government need to work together at implementing mechanisms that will also restore the supply side of the market.” * The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood. Tightness of listing supply is significantly reducing days

on market, properties are selling very quickly.

This listing content provided by REALTOR.ca has been licensed by REALTOR® members of The Canadian Real Estate AssociationThe trademarks MLS®, Multiple Listing Service® and the associated logos identify professional services rendered by REALTOR® members of CREA to effect the purchase, sale and lease of real estate as part of a cooperative selling system. The trademarks REALTOR®, REALTORS® and the REALTOR® logo are controlled by The Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA.

powered by curious projects